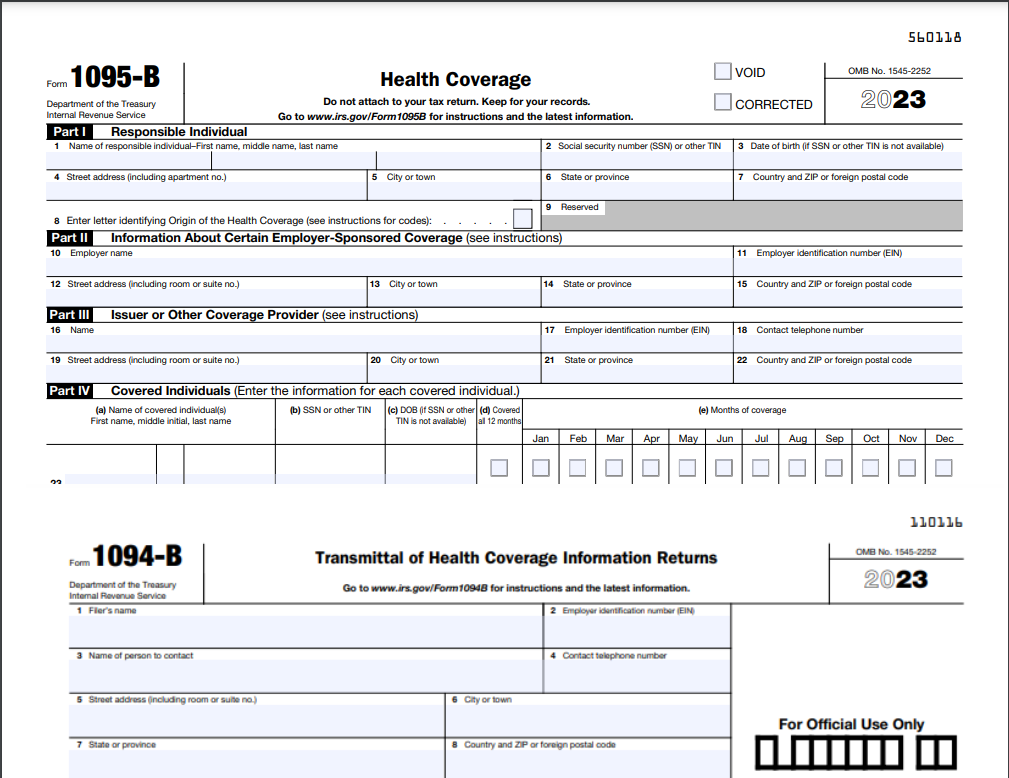

Welcome to BENEFITSCAPE's 1095-B Tax Filing Assistant

Streamline Your Tax Filing Process

With the IRS recently launching its paperless processing inititative, many employers now have to file electronically. Benefitscape can help you file your 1095-B tax forms electronically, efficiently, and easily.

The fee for electronic filing with us is $500, a one-time charge that covers all services required to be fully compliant.

If you miss the April 1st deadline, the IRS penality is $60 per report (maximum of $630,500).

After August 1st, the IRS penality is $120 per report (maximum of $1,891,500).

To avoid these financial penalties and ensure compliance, start today!

You can electronically file with us through one of two ways:

You Have Forms

- You have the forms 1095-B & 1094-B completed.

- Provide us with the completed forms during the filing process

**If your forms have masked Social Security Numbers (SSN), download our sheet below, fill in employee names and SSNs, and include this sheet as well.

You Do Not Have Forms

- You do not have the forms 1095-B & 1094-B completed.

- Download our preformatted sheet below and and enter the appropriate information.

- Provide us with the completed sheet during the filing process.

- We will send the completed forms back to you